Table of Content

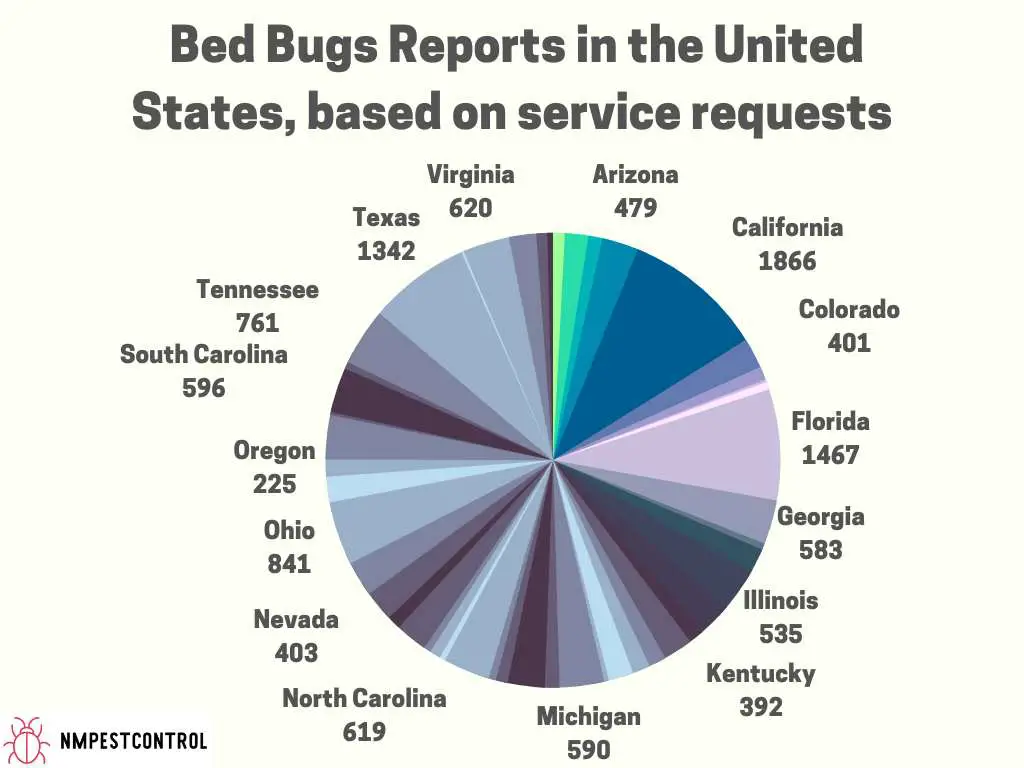

It is also important to note the reason mortgage debt is taken on is taken into consideration. Debt taken on which is considered origination debt or purchase debt has tax-deductible interest. For your convenience current local mortgage rates are published below. The last thing you want to worry about as a homeowner is pests invading your home. To keep critters out of your space, you may need to invest in professional pest control.

Your home may come with major appliances, such as a stove, oven, refrigerator and dishwasher. But if your home is missing any appliances you can’t live without, you’ll need to start saving for them. New appliances can vary widely depending on the type, model and tier (ranging in average between $350 and $8,000) so be sure to account for any missing appliances while you house hunt.

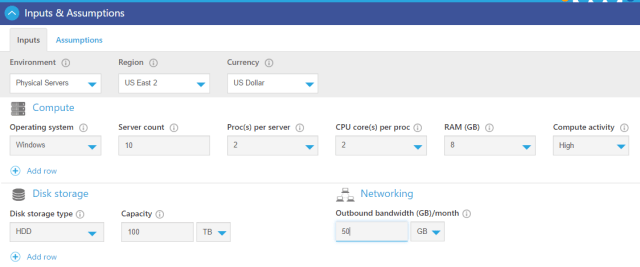

Calculators

The median monthly housing cost in Pittsburgh is just $796, with the second and third least-expensive regions, Birmingham and New Orleans, not too far behind. Although the costs of moving and temporary housing are not deducted from your net proceeds at closing, they're still expenses to consider when deciding to sell because they are out-of-pocket... The standard costs of the home sale transaction, paid at closing. By 2001, the homeownership rate had reached a record level of 68.1%.

Outside of California, the region with the highest home owning costs is Northern New Jersey, which has the highest real estate taxes in the country. At closing, escrow will ensure you've paid your share of the property's taxes up to the date of closing. Homeowners pay property taxes in a variety of ways; sometimes twice yearly in lump sums, or monthly...

How to Calculate Total Cost of Ownership

Try our rent or buy calculator to determine if buying or renting a home makes more financial sense. Your home is likely one of the biggest purchases you will ever make, and your home equity is possibly a large percentage of your personal wealth. Despite your home’s large financial role in your life, you may be surprised to learn the true cost of home ownership.

One of the many homeownership benefits is being able to change the color of your kitchen cabinets or replace those wall-to-wall carpets. While costs widely vary, the 10 most popular home renovation projects cost anywhere from a few hundred to several thousand dollars. Down payments can range anywhere from 3% to 20%, depending on your loan type and the home’s sale price. There are low down payment mortgage options that make it possible to buy a home with less money down. Buying a home costs between 3% and 6% of the price in closing costs and up to 20% for the down payment. If you work from home for any part of the time, you can also deduct your mortgage expenses from your taxes.

Renovation and Remodeling Costs

You may have to come up with deposits to the utility and phone or cable companies to turn on their services as well. To estimate your monthly utility costs, ask the home seller to share what his or her typical monthly utility expenses have been. Recognize that water, electricity and gas may fluctuate with the seasons and check with your local utility to see if they offer balanced monthly payment plans. The realtor.com® rent vs. buy calculator is a tool to help you compare the cost of renting or buying a home over time.

Then plug in your state and federal tax rate and your standard deductions. We’ll e-mail you a complete financial analysis of what you can save in the coming years based on the interest you pay. Closing costs—the fees paid at the closing of a real estate transaction. These costs typically fall on the buyer, but it is possible to negotiate a "credit" with the seller or the lender. It is not unusual for a buyer to pay about $10,000 in total closing costs on a $400,000 transaction. When you take out a mortgage, you have the ability to repay it over a predetermined term .

Condo Fees

In 2018 the standard deduction for individuals or married people filing individually is $12,000. The standard deduction for a head of household is $18,000 & the standard deduction for married couples filing jointly is $24,000. Further, the combined limit on deducting property taxes with state income or sales tax will be set to $10,000 per year. In 2021 the standard deduction for individuals or married people filing individually is $12,550.

Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. The amount of money you need to save as a homeowner can feel unclear . But once you make it past the number crunching you’ll be more prepared to take the leap. From broken appliances to landscaping, there are bound to be some expenses that you may not have considered.

On the flip side, an incredibly efficient home or even one that uses net zero energy without a large purchase price premium might make a home much cheaper to live in than neighboring homes. Your new home is likely to be bigger than your apartment and may require some extra furnishings. While some appliances such as dishwashers and ovens are considered fixtures and are included in your home's sale price, portable appliances like washers, dryers and refrigerators are not always included.

The annual real estate tax in the U.S. varies by location; on average, Americans pay about 1.1% of their property's value as property tax each year. This type of insurance is meant to cover the dwelling, personal property, personal liability, etc. . The annual cost of homeowners insurance is often estimated as a percentage of the property value, averaging about 0.4%. It is not just the loan payment that is important to consider, but also the property tax, insurance, maintenance, and home improvements. New homes do, of course, come with small annual maintenance costs – annual HVAC maintenance, semi-annual landscaping, rain gutter cleaning. However, none of these costs compares to repairing or, worse, completely replacing items in and around your home, such as an old hot water tank or a yard that needs a total overhaul.

A debt-free status also empowers borrowers to spend and invest in other areas. These costs aren't addressed by the calculator, but they are still important to keep in mind. To be conservative, you may want to disregard the tax adjustment when estimating your home expenses.

Here's an appliance budgeting worksheet from Freddie Mac that illustrates how much you may have to come up with soon after closing on your home purchase. You can also estimate the age of some major appliances using this tool. If this sounds like a lot of money to have to come up with each year, it's important to know that you are unlikely to spend all of that cash every year. A roof or heating system replacement done this year may never have to be done again in the time you own your home, for example. These costs are spread out over your home ownership period, but unfortunately, you usually have to pay for them up front .

Mortgage calculator

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. This free calculator lets you find out how much you are spending on your home in monthly recurring costs and how that compares to what others are spending. Yes, there are many costs to owning a home that people might forget about when purchasing one.

No comments:

Post a Comment