Table of Content

Costs will vary and while some may only impact your wallet once, others could be periodic and might need to be factored into your regular budget. Some costs will be predictable, while others can pop up without much warning. Having an idea of what expenses to expect can help prevent sticker shock — and help you prepare for when they come your way. The cost of renting in a city is often used to determine its affordability, but as the map above shows, owning property is a whole different ballgame. If you already live in a region that has promising potential for career growth, figuring out if you can afford to own a home there may be the next step in your journey. Loss of tax deduction—Borrowers in the U.S. can deduct mortgage interest costs from their taxes.

Transfer taxes range widely by location because they're applied... In some markets, you are required to hire a closing attorney as part of the selling process. The cost of a closing attorney deducts an additional $800-$1,200 from your profit. Sellers usually pay both their listing agent's commission and the buyer agent's commission charges, generally 2-3% of the home sale price per agent.

Homeowners May Want to Refinance While Rates Are Low

If your air conditioning stops working or the refrigerator conks out, it’s up to you to repair or replace it. A solid emergency fund can help prepare you for these unwelcome expenses so you’re not left in the lurch. A good rule of thumb is to save between three and six months’ worth of essential expenses.

If your house appreciates throughout the duration of ownership you are allowed to obtain some capital gains tax-free. Individual homeowners have a cap of $250,000 while married couples have a cap of $500,000. Requirements include not having used this provision in the last 2 years and the house serving as your primary residence for at least 2 of the past 5 years. Given the current low-rate environment, you may be able to save thousands by locking in today's low rates. After plugging in all of this information, you can determine the tax benefit of your home, which will help you determine the amount you are really paying for your mortgage each month.

Ally Tools & Tips

Performance 5 Ways to Reduce Unplanned Downtime Looking for ways to stop unplanned downtime? ProMix PD Proportioning Systemreduces solvent and material waste by moving the mixing point closer to the gun. This design feature ensures that the material is mixed precisely before it is sprayed. This means that more of the expensive materials and solvents can be used for their intended purpose rather than incinerated. This especially impacts the TCO for companies who change colors multiple times per day. Operation is the cost to install the pump, test the pump, train employees to run the pump, and the cost of energy to operate the pump.

While you can’t foretell every extra expense, there a some you can try to anticipate. If your home is part of a Homeowners Association, you will owe a prorated portion of the fees based on your closing date. During a purchase and sale transaction, the seller usually hires an escrow company to act as a third party to oversee the buyers earnest money and final purchase funds. Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes. Personal satisfaction—The feeling of emotional well-being that can come with freedom from debt obligations.

year or 30-year Term?

In exchange, you’ll receive home improvements and maintenance and upkeep of any shared space, like a pool, gym or community center. Third-party fees, which can include title search fees, title insurance, attorney fees, recording fees and tax certification. In some cases, appraisal and inspection costs are included in your closing costs, but not always.

Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure (17.8 MB PDF), also known as the options disclosure document. It explains in more detail the characteristics and risks of exchange traded options. Options investors may lose the entire amount of their investment in a relatively short period of time.

Unexpected expenses after buying a house

The average cost to hire movers for a local move is $1,400, whereas out-of-state moves can range from $700 to $10,000. You can also save a bit of money by moving yourself, which costs between $250 and $350 for local truck rentals and up to $2,400 for long-distance treks. Closing costs are the additional fees and charges for buying a home and closing on a mortgage.

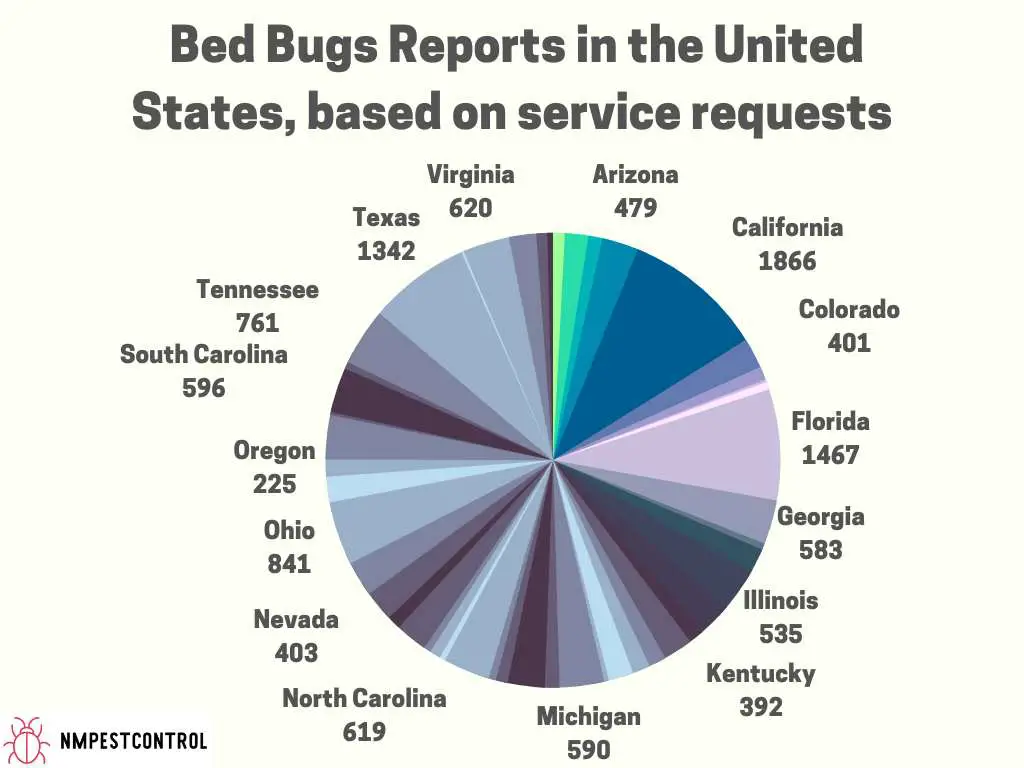

It is also important to note the reason mortgage debt is taken on is taken into consideration. Debt taken on which is considered origination debt or purchase debt has tax-deductible interest. For your convenience current local mortgage rates are published below. The last thing you want to worry about as a homeowner is pests invading your home. To keep critters out of your space, you may need to invest in professional pest control.

Consult with an accountant to determine what your tax rate will be and whether you ought to take the standard deduction instead. Many first-time home buyers find it better to take the standard deduction their first year, particularly if the home is not purchased until the middle or end of the year. Find out how much monthly mortgage payments might be with a fixed-rate mortgage. A fixed-rate mortgage has an interest rate that doesn't change for the entire loan term.

Enter a ZIP Code, select your home's current age, and click "Apply" above to see results. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

In fact, 83% of sellers make a concession to finalize an offer according to the Zillow Group... Many homeowners avoid capital gains taxes when selling their primary home by qualifying for the capital gains tax exemption. First, you must have lived in the home for at least two of the last five years... Sellers make a one-time payment for the new owner's title insurance at closing. This insurance protects the new owner of the home from any disputes over claim to the title of the property or outstanding... Your listing agent commission usually covers online listing fees, professional photography and videography, advertising on social media and open house expenses such as yard signs, listing flyers...

Your monthly payments will stay the same with this type of mortgage. The amount of property tax you may owe is usually a percentage of your home’s assessed value based on appraisals from your county assessor. Failing to pay your property taxes on time can result in tax liens on the home and the risk of foreclosure. Unless you are buying with cash, you will probably rely on a combination of a down payment and mortgage to fund the purchase of a house. Your down payment will usually be somewhere from 3% to 20%, depending on your financial situation and whether you are a first-time homebuyer. Subtracting your down payment from the purchase price will give you the amount you may need to borrow from a lender via a mortgage.

The deduction has complicated rules, but essentially, you must deduct the proportion of your mortgage that is equal to the proportion of the space you use for your work. Therefore, if 1/5 of your home is dedicated to an office space, you can deduct 1/5 the cost of your mortgage from your taxes. The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. Today, both entities continue to actively insure millions of single-family homes and other residential properties.